FEES

TRANSPARENCY IN PRICES AND SERVICE

In accordance with the Solicitors Regulation Authority SRA Transparency Rules all firms of solicitors with websites are required to publish information on prices of certain services.

The aim of publishing this information is to assist clients and customers to understand the probable costs that will be incurred at the outset of a matter.

All of our fees are subject to VAT, our fees quoted are all quoted excluding VAT which is currently 20%.

Our hourly rates is £200 per hour plus VAT

We may incur disbursements on a client’s behalf during the course of a transaction. Disbursements are costs payable to another organisation which are incurred by us acting on a client’s instructions. These are payable in addition to our fees and are inclusive of VAT where applicable.

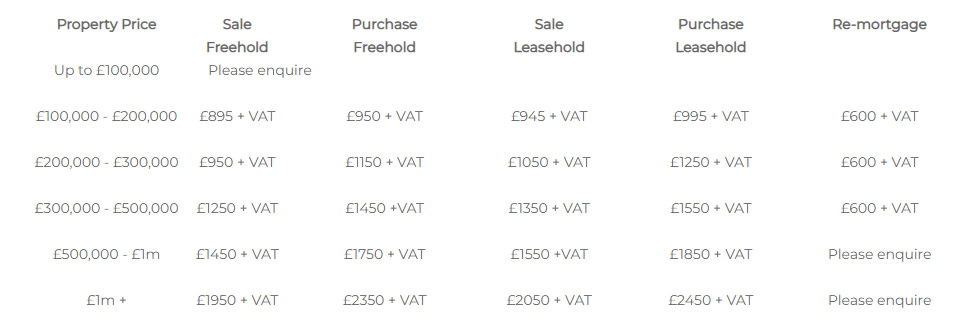

Residential Conveyancing

This encompasses the purchase or sale of freehold and leasehold property and mortgaging and re-mortgaging property.

The prices below are intended to provide our clients with an indication of an average cost of our fees for a conveyancing transaction between certain price points.

On a purchase the disbursements incurred will be for searches (the cost of which vary depending upon where the property is situated) ordinarily in the region of £420, Stamp Duty which is based upon the value of the property/whether you own other property or a first time buyer, Land Registry fees which are based on the purchase price of the property and management company fees. We will advise you of the cost of the disbursements at the outset of the instruction and they will be payable in addition to our fees.

On a sale the disbursements are usually limited to obtaining title documents from the Land Registry which cost £3 per document.

Please note that excluded from the fees quoted are new build properties, shared ownership/section 106 properties and Help to Buy equity mortgages and ISAs (where applicable) which will incur a surcharge in the region of 10% of the quoted fee.

An average conveyancing transaction takes between six-eight weeks. However the time scale could be substantially longer if there are many parties in the chain.

We have listed the work that will be included on an average transaction below which is covered by our average price:-

Purchase of freehold & Leasehold property

Liaising with client through out

Taking instructions and obtaining funds on account

Requesting Contracts from sellers solicitors

Undertaking searches

Raising enquiries

Reporting to clients with results of searches and enquiries

Liaising with estate agents/solicitors/mortgage brokers/management companies through out

Complying with mortgage conditions and drawing down the funds

Preparing and submitting stamp duty return (you can calculate the amount of stamp duty you will need to pay by using HMRC's website)

Exchanging and Completing on the purchase

Registering the property with the Land Registry

Post completion notices

Sale of freehold & Leasehold property

Liaising with client through out

Taking instructions

Preparing Contracts, property information and Land Registry documentation

Responding to enquiries

Liaising with estate agents/solicitors/mortgage company/management companies through out

Redeeming mortgage

Exchanging and Completing on the purchase

Distribution of proceeds

Mortgages & Re-mortgages

Liaising with client through out

Taking instructions and obtaining funds on account

Undertaking searches if required

Reporting to clients

Liaising with mortgage brokers

Complying with mortgage conditions and drawing down the funds

Registering the mortgage with the Land Registry

Post completion notices

Eg. Anticipated fees and disbursements on the purchase of a freehold registered property for £300,000 in Cornwall to be the purchaser’s main residence

Merricks fees

£1,150 +VAT (£234)

Search fees

£413.08

HM Land Registry Fee

£135.00

Electronic Transfer Fee

£20.00

VAT Payable on Merricks

Fees and Transfer fee

£183.00

Stamp Duty

£5,000.00

£6,952.08

We reserve the right to charge an additional fee for the preparation of declarations of trust, statutory declarations, bespoke indemnity policies and lease extensions.

Please click on the Team tab on our website to view the members of our conveyancing team and their respective qualifications.

Probate

This encompasses dealing with the uncontested administration of a deceased’s estate where it is all in the UK.

On a probate matter there are additional costs such the swearing of the executor’s oath (£7 per executor), the Court’s probate fee currently £155 plus £0.50 per copy grant of probate, valuation fees, public notice fees of approximately £166.39 and inheritance tax. We will advise you of the likely cost of these at the outset of the instruction and they will be payable in addition to our fees.

We have listed the work that will be included on an ordinary estate below which is covered by our average price:-

Liaising with client through out

Taking instructions and providing initial advice

Contacting financial institutions to obtain information on the deceased’s accounts

Obtaining Property valuations

Obtaining valuations for personal possession where necessary

Liaising with Funeral directors and settling their account from the deceased’s funds

Preparing and submitting inheritance tax return

Arranging for the settlement of inheritance tax from the deceased’s funds if required

Preparing and submitting the Executor’s Oath or Letters of Administration

Publishing a public notice

Collecting in sums due to the estate

Settling known debts payable by the estate

Preparing estate accounts

Making distributions in accordance with the Will or Letters of administration

Our charges are ordinarily based upon our estimate of the time involved in dealing with the administration of the estate, our fee is not based upon a percentage of the deceased’s estate save for when we act as the executors of large and complex estates where we may charge a value related element of between 0% and 2% of the estate..

For a small estate (up to a value of £325,000) with a valid will, less than five bank accounts or investments and less than five beneficiaries, with no disputes between beneficiaries then an average fee for doing the aforesaid work would be in the region £1,050 assuming it would take in the region of six hours work. For larger estates the cost will increase in accordance with the time taken.

An average time taken to administer a simple estate, but excluding the sale of a property, would be in the region of three to six months. A more complicated estate could take up to 12 months.

Factors that can increase the cost of administering an estate can be the number of institutions with whom the deceased held accounts or investments, the number of beneficiaries due to inherit or investigations by the DWP or district valuer.

Excluded from the above would be acting on the sale of a property owned by the deceased. Please see our conveyancing prices for an indication of the probable fee for acting on the sale of the deceased’s property. Deeds of variation would also be charged separately on an hourly rate.

Please click on the Team tab on our website to view the members of our Probate team and their respective qualifications.

Employment Tribunals

We can advise employees and employers on bringing or defending unfair or wrongful dismissal claims.

We will advise on the ability to successfully bring or defend an employment claim, the preparation of a claim form outlining your case and the nature of the dispute or a response form when a claim has been made against you, the filing of any statements of case and evidence in support and exchanging the information with the other side, preparing or considering a schedule of loss, agreeing a list of issues, a chronology and/or cast list and exploring settlement and negotiating settlement throughout the process and to either arranging Counsel to represent you at the Tribunal or attending the tribunal on your behalf. If Counsel is required then the Counsel’s fees are payable in addition to our own.

Our fees for bringing and defending a straightforward claim for unfair or wrongful dismissal would be in the region of £4,000-£6,000 (excluding VAT)

Factors that could make a case more complex:

If it is necessary to make or defend applications to amend claims or to provide further information about an existing claim

Defending claims that are brought by litigants in person

Making or defending a costs application

Complex preliminary issues such as whether the claimant is disabled (if this is not agreed by the parties)

The number of witnesses and documents

If it is an automatic unfair dismissal claim e.g. if you are dismissed after blowing the whistle on your employer

Allegations of discrimination which are linked to the dismissal

Disbursements

Counsel's fees estimated between £1,000 to £2,000 per day (depending on experience of the advocate) for attending a Tribunal Hearing (including preparation) and are payable in addition to our fees.

Time Scale

The time that it takes from taking your initial instructions to the final resolution of your matter depends largely on the stage at which your case is resolved. If a settlement is reached during pre-claim conciliation, your case is likely to take 6-12 weeks. If your claim proceeds to a Final Hearing, your case is likely to take 24-36 weeks. This is just an estimate and we will of course be able to give you a more accurate timescale once we have more information and as the matter progresses.

Please click on the Team tab on our website to view the members of dispute resolution team and their qualifications.